When it comes to pitching to European investors, it’s important to understand that the process can be quite different from what you might be used to. European venture capitalists (VCs) tend to be more cautious and conservative when it comes to investing, and they may have different expectations and requirements compared to investors from other regions.

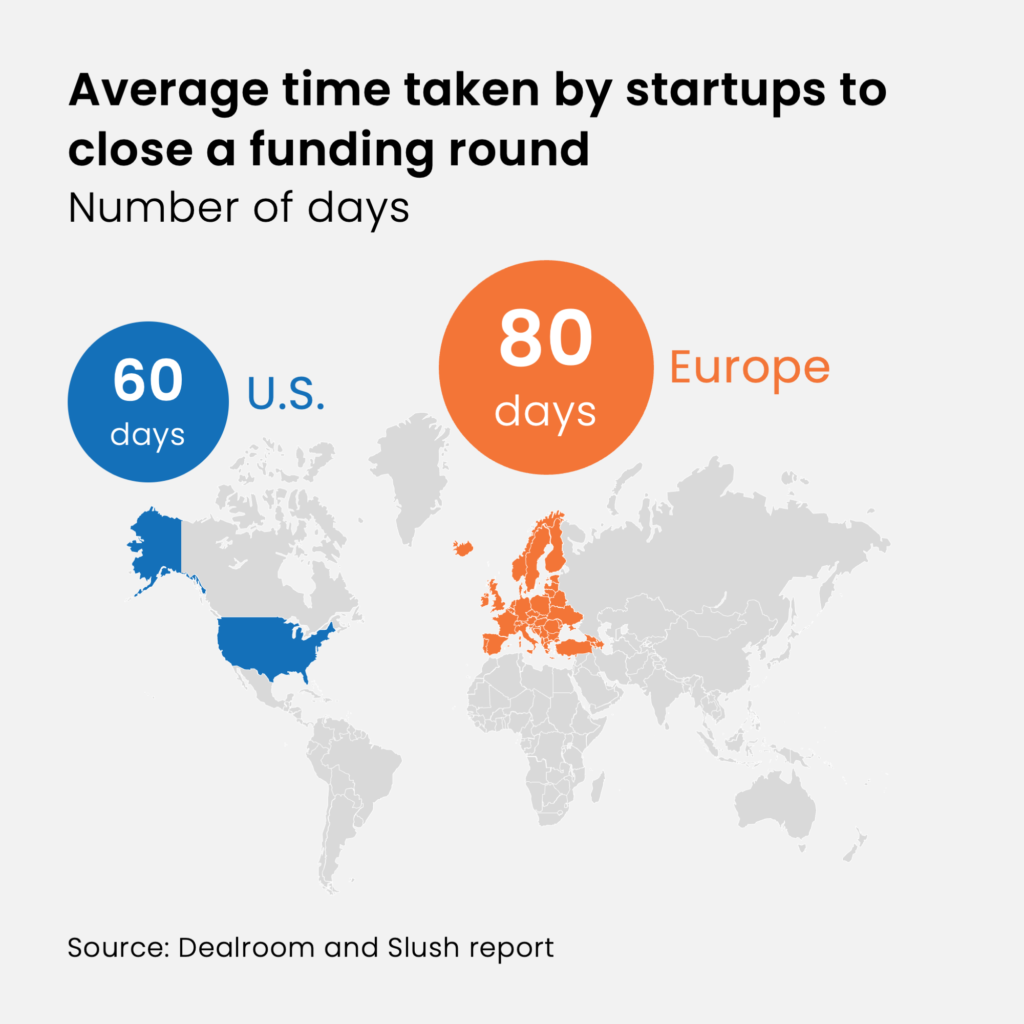

Exhibit 1: Average time taken by startups to close a funding round

Source : Dealroom and Slush report

In this blog, we will delve into top aspects that can significantly impact your pitching journey and increase your chances of securing investment from European investors.

1. Be Prepared for Diligence and Long-Term Commitment

European investors are often meticulous in their due diligence process. They will conduct thorough evaluations of your business, financials, and market viability. Be prepared to provide comprehensive documentation, answer detailed questions, and showcase your long-term commitment to the venture. Develop a robust business plan, financial projections, and growth strategy that aligns with the investor’s expectations. Demonstrating your commitment to building a sustainable and successful business will greatly enhance your credibility during the due diligence process.

70% of European VCs spend more than three weeks on due diligence, compared to just 53% of U.S. VCs. EY Survey

2. Demonstrate Financial Stability and Strategic Planning

When presenting your business to European investors, it is vital to showcase financial stability and strategic planning. A 9-12 month runway signifies that your startup has sufficient financial resources to sustain operations and make progress towards key milestones without immediate financial pressure. It demonstrates that you have thoughtfully planned your funding needs and can allocate resources efficiently. This gives investors confidence in your ability to navigate challenges and execute your business plan.

3. Emphasize on Long-term Sustainable Growth vs. Explosive Growth

European VCs are typically more focused on long-term, sustainable growth, rather than quick, explosive growth. They want to invest in companies that have a clear path to profitability, and are more interested in companies that can show a sustainable business model and a clear plan for generating revenue. This means you should focus on demonstrating how your business will become profitable over time, rather than just emphasizing growth potential. This focus reflects the long-term investment strategy of European VCs.

4. Thoroughly Research the European Investor Landscape

European investors value thorough research and preparedness from entrepreneurs. Before approaching investors, invest time in understanding their investment preferences, sector focus, and geographic interests. Research their portfolio companies to identify synergies and potential alignment. Additionally, anticipate their likely questions and concerns, and prepare compelling answers that address these points. Demonstrating a deep understanding of the investor’s background and being well-prepared will leave a positive impression during your pitch.

The conclusion: To successfully pitch to European VCs, you need to understand their investment criteria and create a compelling pitch deck that addresses their specific concerns and interests.

European VCs are likely to spend more time reviewing your presentation and conducting their own research before making a decision, which means you should invest extra time and effort towards crafting a compelling, well-structured, and visually captivating deck. By showcasing your business’ potential for robust and sustainable growth, along with its profitability prospects, you significantly enhance your chances of securing their enthusiastic investment.

Explore all our presentation design services

We use storytelling and design to build high impact presentations for leading brands

PowerPoint design services and outsourcing

Enterprises, analysts, consultants

Investor pitches and fundraising narrative

Founders, fund managers

Sales presentations, proposals, and collaterals

Sales & marketing teams

PowerPoint template and visual slide bank

Enterprises, advisory & research firms

CXO presentations and thought leadership

IT-BPO services & consulting firms

Financial, ESG, and annual reports

Financial services, large enterprises

Training - PowerPoint design and visualization

Sales team, analysts, consultants

Conference and event presentations

Keynote speakers, event managers

Book a discovery call

Let's Discuss Your Needs and Explore Solutions