Master your investor pitch: Avoid these 7 deadly sins

August 3, 2024 | 4 min read

The exuberance of 2021/2022 is over.

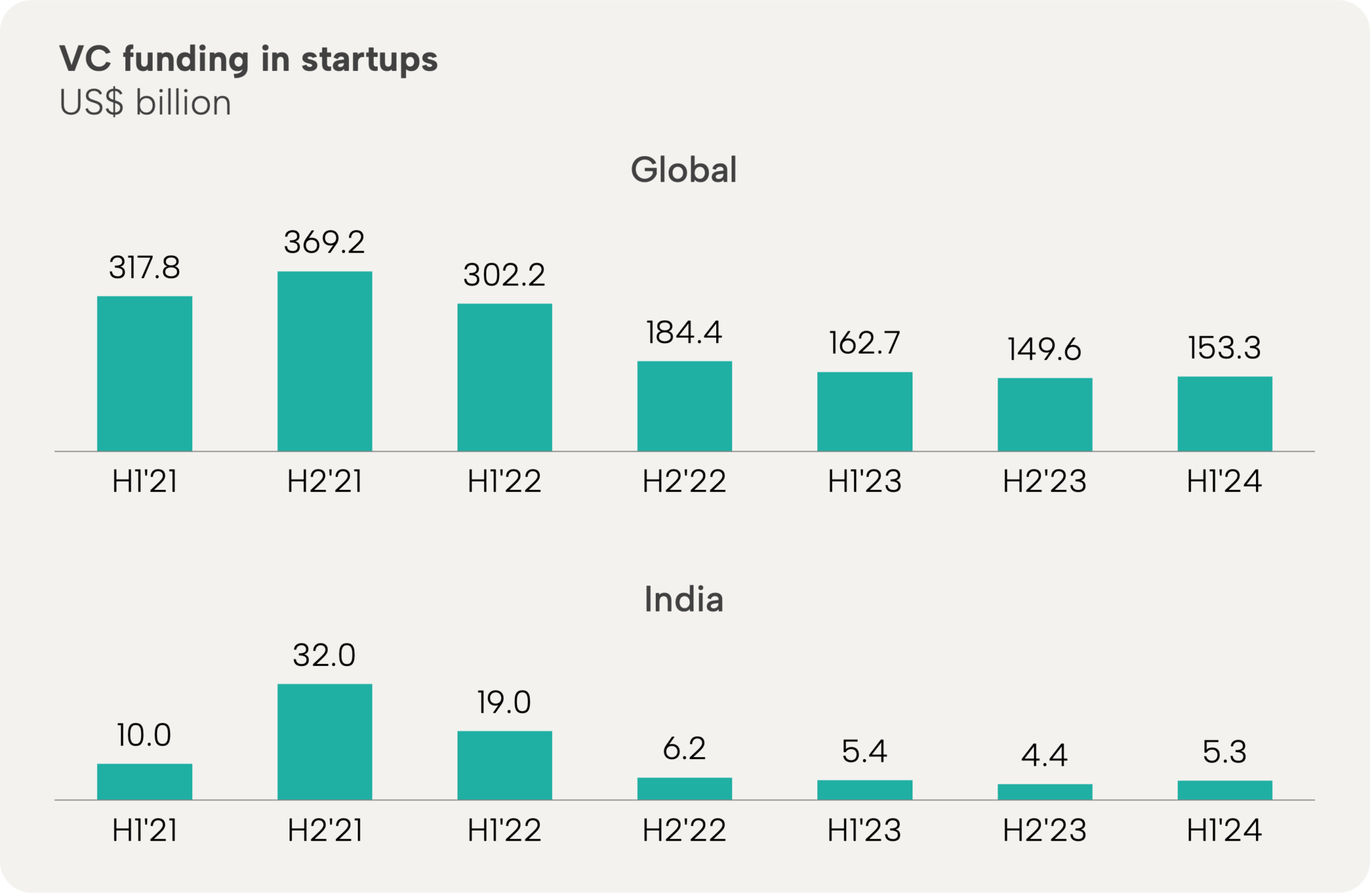

VC funding was at its peak in 2021 and 2022, where it seemed every other startup was getting funded. However, the landscape has drastically changed, as shown in Exhibit 1. The data reveals a significant decline in global and Indian startup funding over the past two years, with the trend continuing into the first half of 2024 compared to H1 2023.

Moreover, venture funding in India has dropped to pre-2017 levels, according to the Blume Indus Valley Annual Report 2024. There has been a 60% decline in the number of deals being funded.

Why, you ask? For starters, there’s no dearth of innovation. Every startup wants to make the world a better place. That means investors have become selective and have a hard time making a decision about who deserves their money the most.

So, there’s no easy way to say this, but securing funding for your startup is literally a hard sell now. That’s where the pitch comes in.

The objective of your investor pitch is to help them choose you. Period.

But, well, evidently, most investor pitches fail to do exactly that. Do you know where they’re going wrong? That’s what I’ll be sharing today: my list of 7 deadly investor pitch sins and ways to avoid them.

Read on if failed pitches are still giving you sleepless nights.

1. All numbers and no story

There’s no investment if there’s no emotion. Numbers are cold; stories are warm. That’s why storytelling sets the frame for the discussion about numbers.

To avoid this sin, create a narrative that highlights the problem you’re solving (the pain point), its significance, and the impact your solution can make. Paint a vivid picture that allows investors to visualize the journey of your business and the potential it holds.

People don’t buy what you do; they buy why you do it.

– Simon Sinek

2. Ignoring the target audience

Failing to address your target audience in your pitch can undermine its effectiveness. When investors are unable to see that you understand your customers and their needs, your business looks like a sinking ship to them.

Clearly define your target audience and the problem you are solving for them. Explain in your pitch how your solution effectively addresses the problem and meets the needs of your target audience.

Step 1: Define the problem

Example: “Small businesses lose over $50 billion annually due to inefficiencies in managing their inventory.”

Step 2: Present your solution

Example: “Our inventory management software reduces errors by 40% and saves businesses an average of $10,000 annually.”

3. Inability to articulate value and market opportunity

A rather common but fatal pitfall in pitches is the failure to effectively communicate the value proposition and market opportunity. More than 30% of startups and small businesses fail for the lack of proper product-market fit.

Investors want to understand how the product or service solves a real problem and has a sizable market to address. Clearly define your target audience and how large this segment is within the broader market.

Step 1: Industry market size and growth

Example: “The global market for inventory management solutions is expected to reach $5 billion by 2025, growing at a CAGR of 12%.”

Step 2: Market potential of your target audience

Example: “We are initially targeting small to medium-sized businesses in the retail sector, which constitutes a $1 billion market.”

4. Information overloaded

8 to 12 seconds is all you have with each slide of the deck you present. You can’t pack 10 pounds of sh*t in a 5 pound bag and expect your presentation to be a success. Information overload can quickly lose investors’ attention and dilute your key messages.

Instead, focus on creating a concise pitch that highlights the most critical aspects of your business. Give information that is relevant to your investor and leave room for follow-up discussions and inquiries.

A pitch should be like a stripper’s dress; long enough to cover the subject, but short enough to keep it interesting.

– Guy Kawasaki

5. Presenting as a solopreneur or a weak team

A one-man-army or even three-men-army for that matter, in the eyes of an investor, is a weak plan. The strength of the team is one of the top criteria for investors when evaluating a startup. Having a weak, do-it-all team or being a solopreneur who’s always juggling, can raise doubts about your ability to execute the business plan.

Highlight your experience, relevant expertise, and achievements as a solo founder along with the support team. If you have co-founders or advisors, emphasize how their individual skill sets are complementary to the overall growth of the startup.

Great things in business are never done by one person. They’re done by a team of people.

– Steve Jobs

6. There’s no real business moat

Nothing weakens your pitch like the lack of a real business moat, or sustainable competitive advantage. Investors want to see how you differentiate yourself and create barriers to entry for competitors.

Highlight your unique value proposition, intellectual property, proprietary technology, strategic partnerships, or any other factors that give your business a competitive edge.

Demonstrating a competitive advantage

Example: “Unlike our competitors, our solution integrates seamlessly with existing e-commerce platforms, providing a distinct competitive edge.”

7. Projecting unrealistic financial goals

Presenting overly optimistic or unrealistic financial projections is bound to raise red flags and erode trust, especially if you are unable to justify those. It’s essential to showcase a solid understanding of your business model, revenue streams, and anticipated expenses.

Be transparent and realistic with your projections, taking into account market dynamics and potential challenges. By demonstrating a grounded and thoughtful financial plan, you enhance your credibility and show investors that you have a realistic path to success.

Back your revenue projections

Example: “Based on our initial traction and market analysis, we project reaching $5 million in revenue within three years.”

The conclusion: Preparation and attention to detail can make the difference between securing the investment you need and missing out on a crucial opportunity.

Since navigating the complexities of securing VC funding hasn’t gotten any easier over the years, you can never be too careful with your pitch. However, avoiding these seven common pitch mistakes can significantly improve your chances of standing out in a crowded field. Remember, the objective of your investor pitch is to help the investor choose you among thousands of others. The art is to eliminate as many flaws in your pitch as help you present what you actually mean to.

You may also like

We use storytelling and design to build high impact presentations for leading brands

PowerPoint design

services and outsourcing

Enterprises, analysts, consultants

Investor pitches

and fundraising narrative

Founders, fund managers

Sales presentations, proposals, and collaterals

Sales & marketing teams

PowerPoint template and visual slide bank

Enterprises, advisory & research firms

CXO presentations

and thought leadership

IT-BPO services & consulting firms

Financial, ESG,

and annual reports

Financial services, large enterprises

Training – PowerPoint design and visualization

Sales team, analysts, consultants

Conference and event presentations

Keynote speakers, event managers