How VC fund managers can make their fund pitch stand out to LPs?

July 3, 2024 | 4 min read

Raising capital is the lifeblood of any venture capital (VC) firm.

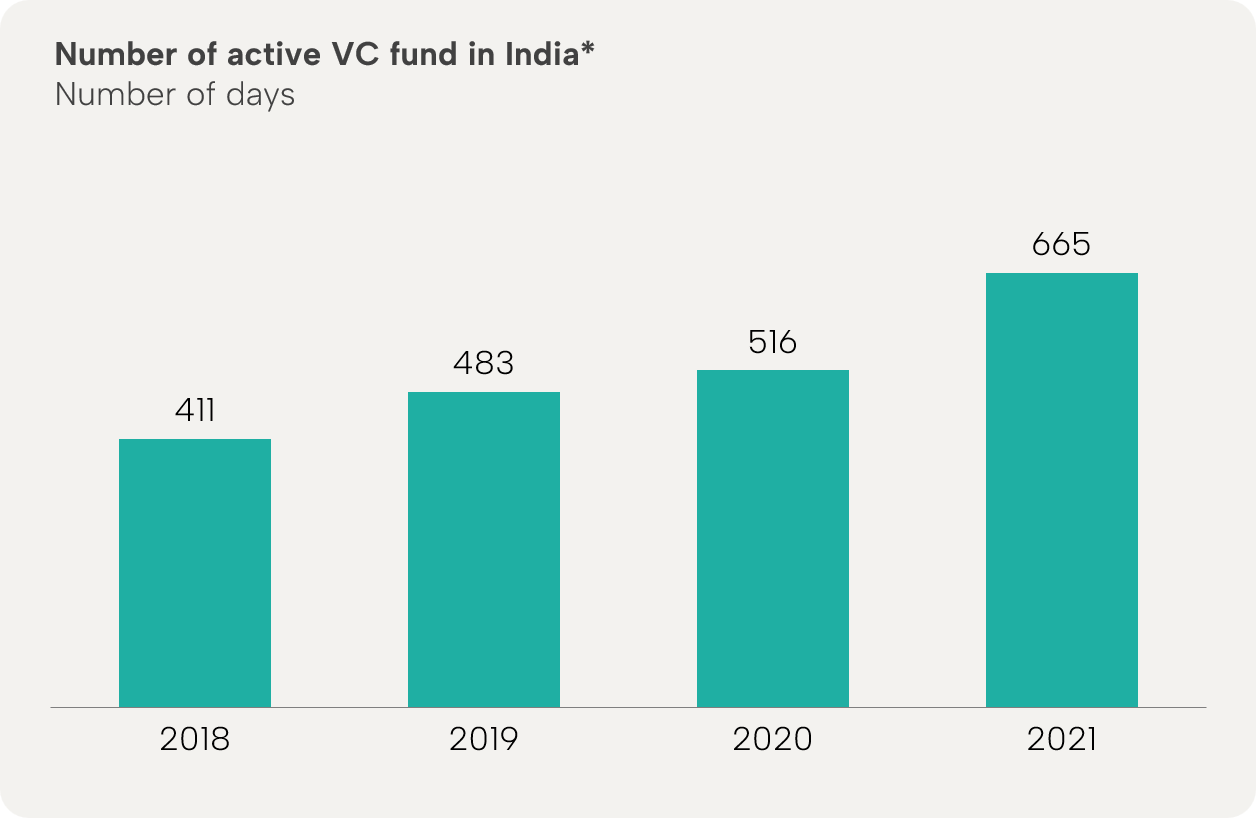

For fund managers, the stakes are higher than ever, with over 660 active VC firms in India alone competing for limited partners’ (LPs) attention. The number of active funds continues to grow, particularly in emerging markets like India (see Exhibit 1).

Exhibit 1: Active VC funds in India have grown steadily over the last few years; growing participation from micro VCs, family offices

*Active investors defined as investors with at least one investment in the year

Source: India Venture Capital Report 2022

In such a competitive environment, every VC fund pitch needs to grab the attention of the same LPs. It’s important for fund managers to go beyond the basics and craft a compelling narrative that stands out.

When we launched Qcept Presentations in 2019, our first client was a leading micro VC firm. Since then, we have had the opportunity to work with several VCs across various stages—Pre-Seed, Series A-B, Series C+—and in different geographies, including the U.S., Germany, and the UK. Throughout this journey, we’ve gained valuable insights while helping them create fund pitches, investor teasers, and quarterly LP updates.

These lessons extend beyond the typical components of a good pitch deck. We’ve identified a few key strategies that can truly make your pitch stand out:

1. Start with a hook and not market insights

To truly captivate LPs, stay away from the traditional market-centered approach that LPs have encountered in numerous other pitches. Instead, begin your pitch with an intriguing hook that sparks curiosity. By avoiding the mundane and diving straight into what makes us distinctive, we immediately seize the attention of our audience.

Example:

Instead of beginning with “The Indian startup ecosystem is growing rapidly with over 40 unicorns…” consider opening with a compelling statement like, “Our fund was the first to identify and back a company that grew to a $1 billion valuation in under 3 years.” This grabs attention instantly by presenting a striking success story rather than predictable market data.

2. Embrace your unique proposition

What sets your VC fund apart? Is it your extensive industry network, proprietary deal flow, or a unique approach to due diligence? Identify your fund’s unique selling points and weave them into your pitch. For instance, if your team has a successful track record in a particular sector, highlight this as a competitive advantage that positions you to identify and nurture high-potential startups.

Example:

If your VC fund specializes in FinTech and you’ve built strong relationships with key regulatory bodies, emphasize that as a differentiator. You could say, “Our strategic connections with financial regulators allow us to navigate regulatory hurdles seamlessly, enabling our portfolio companies to scale faster in a heavily regulated industry.”

3. Clearly articulate your investment thesis

At the core of every successful VC fund pitch is a well-defined investment thesis. Clearly articulating the sectors, industries, or technologies your fund intends to focus on. Emphasize the rationale behind your choices, showcasing your insights into market trends and growth opportunities. Highlight how your chosen focus aligns with your team’s expertise, creating a compelling case for why LPs should trust your fund to navigate these waters.

Example:

Imagine your focus is on clean energy. You could state, “Our fund focuses on early-stage startups in the clean energy space, with a specific emphasis on technologies that reduce carbon emissions. Our rationale stems from growing regulatory pressures on corporations and the increasing consumer demand for sustainable energy solutions.”

4. Employ data visualization to showcase your track record

Your track record is more than just a chronological sequence of accomplishments; it’s a narrative of success. Utilize the power of data visualization to craft graphical representations that succinctly capture the growth trajectory of your past investments. These visual cues resonate more powerfully than words alone, reinforcing your fund’s capabilities.

Example:

Instead of listing your fund’s past successes, visualize the data: use a line graph to show the compounded annual growth rate (CAGR) of your investments or pie charts that break down your sector exposure and returns. For instance, “Over the past 5 years, our FinTech portfolio has achieved an average CAGR of 25%.”

5. Illustrate alignment of interests

Transparency is key. Clearly present your fee structure, carried interest model, and any co-investment opportunities available to LPs. Illustrate how your financial incentives are tightly aligned with the fund’s performance, assuring LPs of your commitment to mutual success.

Example:

You could say, “We have a tiered carried interest model where we only receive our performance fee after hitting a 15% IRR threshold, ensuring that our success is closely tied to the fund’s performance. Additionally, we co-invest 4 times more than regulatory requirments in each fund, meaning our financial commitment is aligned with yours.”

The conclusion

As you strive to set your fund apart, these strategies go beyond the norm, infusing your VC fund pitch with an alluring essence that captivates, resonates, and lays the foundation for a partnership that transcends the ordinary.

Keep in mind, the most impactful pitches are those tailored to and resonating with the intended audience (in this scenario, LPs). Focus on presenting what they seek to aid their decision-making, rather than conveying your own aspirations.

You may also like

We use storytelling and design to build high impact presentations for leading brands

PowerPoint design

services and outsourcing

Enterprises, analysts, consultants

Investor pitches

and fundraising narrative

Founders, fund managers

Sales presentations, proposals, and collaterals

Sales & marketing teams

PowerPoint template and visual slide bank

Enterprises, advisory & research firms

CXO presentations

and thought leadership

IT-BPO services & consulting firms

Financial, ESG,

and annual reports

Financial services, large enterprises

Training – PowerPoint design and visualization

Sales team, analysts, consultants

Conference and event presentations

Keynote speakers, event managers